Translation and analysis of words by ChatGPT artificial intelligence

On this page you can get a detailed analysis of a word or phrase, produced by the best artificial intelligence technology to date:

- how the word is used

- frequency of use

- it is used more often in oral or written speech

- word translation options

- usage examples (several phrases with translation)

- etymology

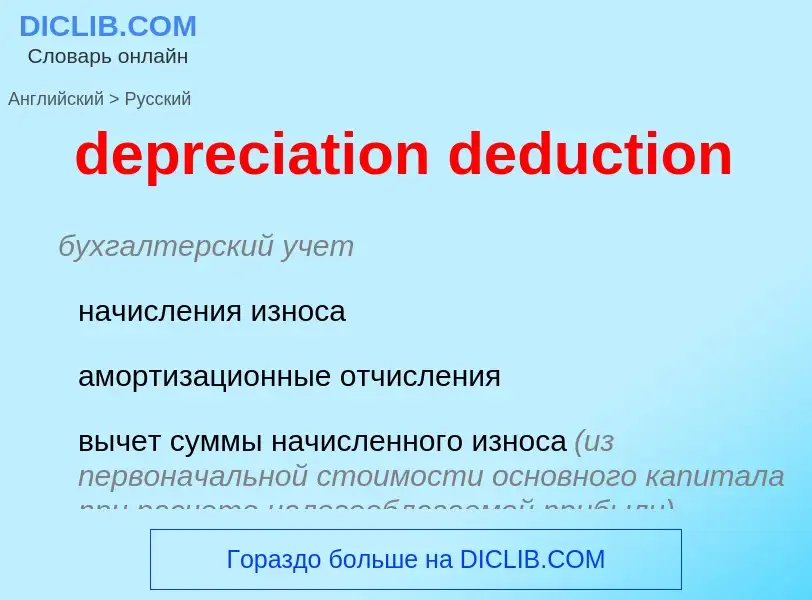

depreciation deduction - translation to English

бухгалтерский учет

начисления износа

амортизационные отчисления

вычет суммы начисленного износа (из первоначальной стоимости основного капитала при расчете налогооблагаемой прибыли)

синоним

2) вычет суммы начисленного износа (из первоначальной стоимости основного капитала при налогообложении)

Смотрите также

Definition

Wikipedia

Section 179 of the United States Internal Revenue Code (26 U.S.C. § 179), allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated. This property is generally limited to tangible, depreciable, personal property which is acquired by purchase for use in the active conduct of a trade or business. Buildings were not eligible for section 179 deductions prior to the passage of the Small Business Jobs Act of 2010; however, qualified real property may be deducted now.

Depreciable property that is not eligible for a section 179 deduction is still deductible over a number of years through MACRS depreciation according to sections 167 and 168. The 179 election is optional, and the eligible property may be depreciated according to sections 167 and 168 if preferable for tax reasons. Further, the 179 election may be made only for the year the equipment is placed in use and is waived if not taken for that year. However, if the election is made, it is irrevocable unless special permission is given.

For regular depreciation deductions in the United States, see MACRS.